…… AND WHY!

It’s that time again ….. tax returns!

From the 6th of April, accountants start to request information from clients. In this blog, we will go through what information accountants need and why.

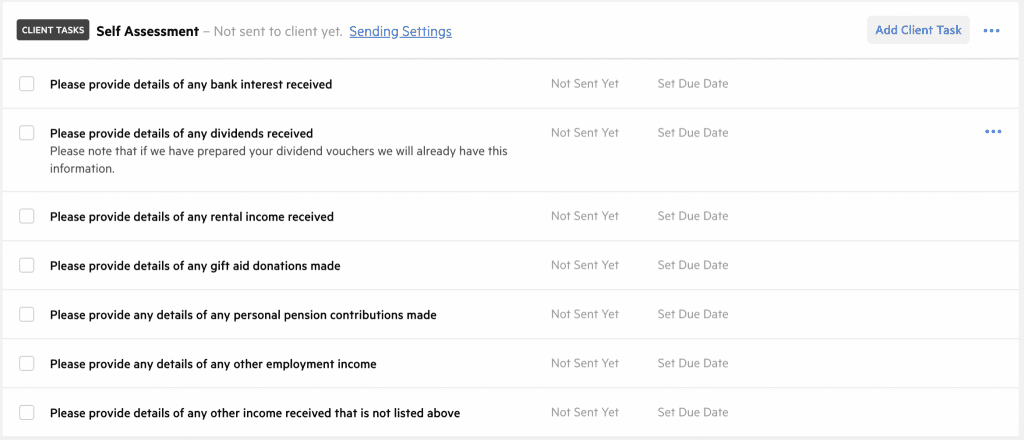

At 1 Accounts we request the below information from all of our clients via our Karbon software. A secure virtual checklist gets sent to every client automatically on the 6th of April. For more details on when and how to send your tax return information to us please *click here*. Not all of the checklist points apply to everyone, however, we ask all of our clients to write N/A by the tasks that don’t apply, this confirms to us that they aren’t applicable.

Bank Interest

You have to declare your bank interest received on your tax return. You do not have to pay tax on any interest under £1,000 if you are a basic rate taxpayer or £500 if you are a higher rate tax payer. If you are an additional rate taxpayer, you will have to pay tax on all of your bank interest. However, regardless of the amount you still have to declare any interest you have had. Depending on your bank you will get an April summary that will tell you your annual interest. Your bank should also be able to provide an interest statement on request. Failing both of these, you can just look through your bank statements and add up any interest received, however, this could be long, time-consuming and most of all boring.

Details of Dividends

Your dividends are taxable income (after £2,000), so they have to be declared on your tax return. To send us the details we will need the dividend vouchers. If you do not have these you will be able to ask your accountant managing your business to send them to you. If you are a 1 Accounts client and we look after your company, we will have the dividend information for that business.

If you have invested in any shares, you will also get a dividend certificate. Keep hold of these even if just for a small amount as this will also need to be declared.

Details of rental income and expenses

We will need to know the gross rent. This is the amount of rent that you are paid before any management charges. We will also need a list of your expenses obtained throughout the year. If you have an agent you should be able to ask for a ‘rental statement’. If you don’t have an agent please send us a spreadsheet of your expenses and details of the rent paid to you every month.

Some of our rental clients use Xero to keep track of their income and expenditure. If you would like a version of Xero to be able to do this, just let us know.

Donations Under Gift Aid

This one is a little trickier to find the information. If you have donated through ‘just giving’ or have a monthly subscription to a charity you will be able to find the donation given. All we need is for you to add all the donations together to give us the total figure donated, confirm who you donated too and that it was made under gift aid. Remember that donations made under gift aid will REDUCE YOUR TAX if you are a higher rate taxpayer and so it is worth noting down whenever you give to charity.

Pension contributions

This is another one that you could get tax relief on, depending on the type pension scheme and how the contributions are made into the scheme. We will need the details of all the amounts that have been paid into a pension scheme, whether by you or on your behalf by say your employer. Dependent on your pension provider you should be able to get a statement for the year. If this is applicable we will need to discuss this with you further.

Employment income

If you are employed we will need details of this income from either the P60 or P45. This is because it is part of your total taxable income for the year and is needed to decide your tax band. We will need your P60 or P45 from any employer for whom we don’t run the payroll and don’t worry, any tax deducted at source under PAYE will be deducted from your tax bill.

If you are in receipt of you pension, we will also need this P60 as well.

Details of any other income

If you have had any income that we have not listed above, please tell us. Even if you are not sure it applies. This could include the following:

- P11D employment benefits received.

- The sale of capital assets.

- Inheritance income (if not handled within the estate).

- Sole trade income (if turnover is above £1,000 we need to know).

- Sale of shares.

- Cryptocurrency sales.